It’s the second week of Binance and Coinbase versus the SEC.

Illustration by Mitchell Preffer for Decrypt.

Illustration by Mitchell Preffer for Decrypt.

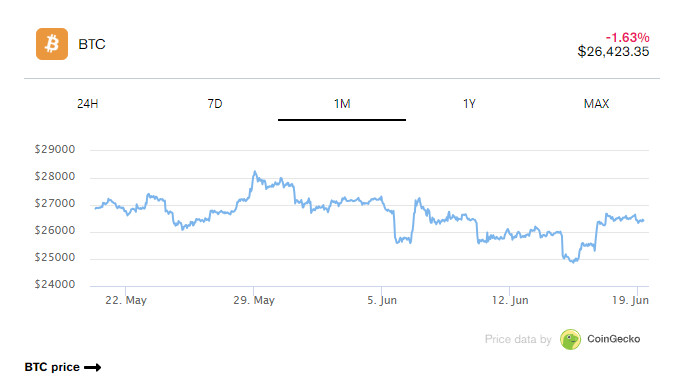

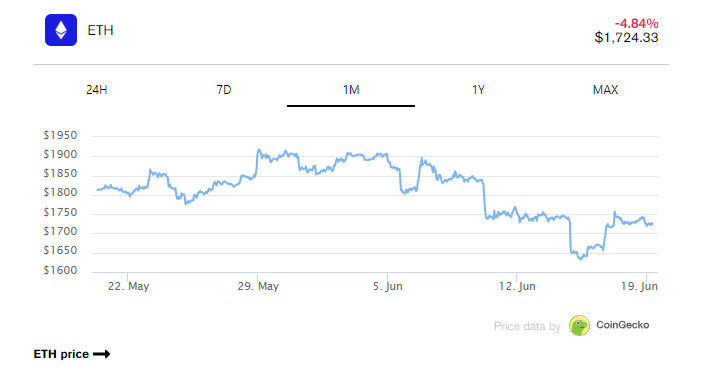

Markets recovered from last week’s crash after readings this week showed that U.S. inflation cooled to 4%, more or less in line with expectations. On Wednesday, the Fed elected not to raise interest rates at a meeting for the first time in eighteen months. Leading cryptocurrencies traded sideways that day but appear to have made some gains entering the weekend.

Bitcoin posted a slight gain of 3% over the last seven days to trade at $26,428 on Saturday. Meanwhile, Ethereum lost 0.6% over the same period and now changes hands at $1,725.

Most leading cryptocurrencies actually posted nominal gains this week. Several rallied hard, including Filecoin (FIL), up 10.3% to $3.71, Cosmus Hub (ATOM) rallied 13.2% to $8.91, Uniswap (UNI) ballooned 14.4% to $4.54 and Polygon (MATIC) surged 9.2% to $0.616745.

None of the top thirty cryptocurrencies by market capitalization posted any notable losses, in spite of the fact that it was the second week of the U.S. Securities and Exchange Commission’s escalation of enforcement actions on the industry.

Binance vs SEC: Week 2!

The week began with news that Binance was lawyering up. It hired George Canellos, a former co-director of the SEC’s Division of Enforcement to help defend itself against 13 civil charges from the securities regulator, including operating as an unlicensed securities exchange.

Also Monday, popular trading app eToro announced it was delisting Algorand (ALGO), Decentraland (MANA), Dash (DASH), and Polygon (MATIC) due to their labeling as securities in the SEC’s lawsuit against Binance. The move mirrored a similar play by Robinhood last weekend and by publicly-listed one-stop crypto shop Bakkt on Friday.

Later that evening, Binance filed more than twenty motions in opposition to the SEC’s lawsuit. However, by the end of the week, Binance’s presence in Europe had shrunk considerably. News broke midweek that Binance was pulling out of Cyprus and the Netherlands while coming under heightened scrutiny from French authorities for “aggravated money laundering.”

Today, a judge approved a consent agreement between Binance and the SEC that one former SEC official said was "burdensome, awkward, inconvenient."

Meanwhile...

The SEC wasn’t the only one in Washington talking crypto this week. On Tuesday, a U.S. Treasury Department representative said at the Transform Payments USA 2023 conference that the U.S. “has not yet determined whether it will pursue a CBDC”—but authorities are currently studying the “potential” of it with an interagency working group.

On Monday, Warren Davidson (R-Ohio) tweeted: “Today I filed the SEC Stabilization Act to restructure the SEC and fire Gary Gensler,” adding, “U.S. capital markets must be protected from a tyrannical Chairman, including the current one.”

Davidson created the legislation with Rep. Tom Emmer (R-MN)—the pro-crypto House Majority Whip who has often blasted Gensler for driving the industry offshore through heavy handed enforcement actions.

The following day, crypto executives assembled before Congress to support a draft bill to regulate crypto. It was praised for establishing clearer requirements for trading platforms to register with either the SEC or the CFTC—requirements which many in the the industry have long said are sorely needed.

That day, House Financial Services Committee Republicans also asked the SEC in a letter to rescind its proposal to change the definition of “exchange.”